Employee Benefits Specialist

Tailoring Employee Benefits to Your Business Needs.

About Aldermont Group

At Aldermont Group, we offer a holistic approach to employee benefits tailored to our clients requirements.

Aldermont Group was established in 2014 by our founder Gareth Thomas, after holding senior sales positions at AXA Health, VitalityHealth and Towergate Health & Protection (formerly The Health Insurance Group).

His drive was to build a boutique advisory service, where the client’s requirements are at the heart of everything we do, with service being a major part of our proposition.

We have continually delivered on our core values since 2014, which is why we grow month on month, year on year and rarely lose a client, evidenced by our 2022-2023 retention rate being 98%.

The Aldermont Group Approach

Holistic Advice

From Private Medical Insurance to Group Risk, and from Business Protection to Employee Wellbeing, we have the knowledge and passion to assist your business in making educated and informed decisions about Employee Benefits.

Consultation Service

We offer a free and no-obligation consultation service where we will take the time to understand your business requirements. We hold an initial meeting to appreciate your current stance towards employee benefits.

Service Proposition

We offer our clients annual market reviews to enable educated decision-making on employee benefits. In addition, we offer ongoing administration & claims support throughout the year. Our most valued client offering is our employee education seminars. These are complimentary for Aldermont Group clients and can be held on-site or virtually. These sessions ensure employees understand their benefits package, how to access the benefits, and highlight how our clients are aiming to support their employees.

Tailored Solutions

We then offer tailored solutions for your business aiming to enhance and improve your employee benefit offering.

What our clients think

Historically, we were paying much higher rates for our health insurance and we were not receiving any type of service. We have now been working with Gareth for more than 4 years. I always feel in good hands with Gareth and I can trust what he says

The quality of customer service we receive is superb. The team take a very proactive approach in managing the insurance services that we have subscribed to. I would thoroughly recommend Gareth and his team. They have a professional desire to fully understand their clients’ requirements

I’ve found him to be very professional and the fact that he personally visits us every year to review our needs and to present the outcome of his market search means the service we get is head and shoulders above what we got from our previous brokers. I’m very happy to recommend.

Why we’re passionate about employee benefits & wellbeing

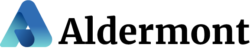

Employee Health & Wellbeing has become a crucial part of a company’s strategy, as evidenced in the CIPD Health & Wellbeing at Work Survey Report September 2023. It was reported that 53% of companies confirmed they had a standalone wellbeing strategy in support of their wider organisation strategy.

This is an increase compared to the same survey conducted in 2022.This increase from 2022, may be attributable to the increase in sickness absence over the last 12 months. Sickness absence has risen from 5.8 days in 2019 to 7.8 days per employee per annum on average, which is the highest level in a decade.

This is why Aldermont Group are passionate about Employee Benefits & Wellbeing. We support companies with their health & wellbeing strategies and aim to assist businesses with sickness absence and creating a healthier more inclusive culture.

Source: SimplyHealth + CIPD Health & Wellbeing at Work Survey 2023

Identifying the causes of sickness absence

Top causes of short-term absence (up to four weeks)

Top causes of long-term absence (four weeks or longer)

Source: SimplyHealth + CIPD Health & Wellbeing at Work Survey 2023

Investing in wellbeing to boost employee engagement is the top opportunity

According to respondents to a SimplyHealth + CIPD Survey across all sectors, the top opportunity for employee health and wellbeing over the next year is boosting employee engagement, followed by embedding wellbeing as part of their retention strategy.

Key Opportunities

These are just some of the benefits cited from implementing a robust health & wellbeing strategy.

Our Products

Select the product for more information.

Health and Wellbeing Products

*Source: Healthwatch England 2021 **Source: SimplyHealth + CIPD Health & Wellbeing at Work Survey 2023

Group Risk Products

Business Protection Products

By sending this message, you are opting to receive information about our services and for us to contact you directly

Get in touch

We’re ready to help